Navigating the Complexities of Pay-roll Conformity: Exactly How Professional Services Ensure Regulatory Adherence

Expert solutions specializing in payroll conformity provide a sign of advice via this labyrinth of intricacies, providing a guard versus possible infractions and charges. By delegating the intricacies of pay-roll compliance to these experts, companies can navigate the regulatory surface with confidence and precision, guarding their operations and making certain financial honesty.

Relevance of Regulative Conformity

Guaranteeing regulatory compliance is critical for specialist services organizations to keep operational integrity and mitigate legal threats. Expert services organizations run in an intricate landscape where laws and regulations are constantly evolving, making it necessary for them to remain abreast of any kind of adjustments and ensure their methods remain compliant.

Expertise in Tax Obligation Laws

Efficiency in navigating elaborate tax policies is essential for specialist services organizations to maintain economic conformity and promote moral requirements. Given the ever-evolving nature of tax obligation regulations, remaining abreast of adjustments at the federal, state, and regional levels is paramount. Specialist companies should possess a deep understanding of tax codes, reductions, credit scores, and compliance demands to ensure accurate financial coverage and tax obligation filing. By leveraging their proficiency in tax laws, these organizations can aid customers decrease tax obligation obligations while avoiding expensive penalties and audits.

Monitoring Labor Laws Updates

Remaining notified regarding the newest updates in labor laws is essential for professional solutions companies to guarantee compliance and alleviate threats. As labor laws are subject to regular modifications at the government, state, and local degrees, keeping up with these advancements is necessary to prevent prospective charges or lawful issues - Best payroll services in Singapore. Expert solutions companies should establish robust devices to keep an eye on labor legislations updates effectively

One way for companies to remain notified is by signing up for newsletters or informs from pertinent federal government agencies, sector associations, or lawful specialists concentrating on labor law. These sources can give timely alerts regarding brand-new regulations, changes, or court judgments that might influence pay-roll compliance.

Additionally, professional services companies can take advantage of pay-roll software program remedies that provide automated our website updates to make sure that their systems are lined up with the most up to date labor regulations. Normal training sessions for human resources and payroll team on current lawful modifications can also boost recognition and understanding within the company.

Minimizing Compliance Threats

Furthermore, remaining informed about regulative adjustments is important for minimizing conformity risks. Professional services companies need to continuously keep track of updates to labor regulations, tax guidelines, and coverage needs. This aggressive strategy makes certain that payroll processes remain certified with the most recent lawful standards.

Additionally, buying worker training on compliance matters can boost recognition and lower errors. By informing team member on appropriate legislations, laws, and finest methods, companies can foster a culture of compliance and lessen the chance of violations.

Benefits of Specialist Payroll Providers

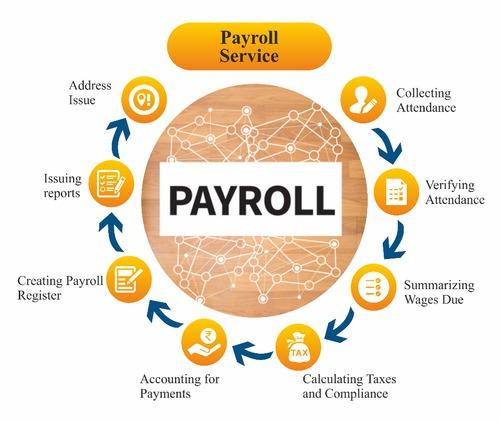

Navigating payroll conformity for specialist services companies can be significantly streamlined via the use of professional pay-roll solutions, using a variety of advantages that enhance efficiency and accuracy in handling pay-roll processes. Specialist pay-roll service browse around here providers are well-versed in the intricacies of pay-roll regulations and can make sure compliance with ever-changing regulations and tax demands.

Another benefit is the automation and assimilation abilities that specialist payroll services use. By automating routine tasks such as computing wages, deductions, and tax obligations, companies can simplify their pay-roll processes and lessen the possibility for blunders. Combination with various other systems, such as bookkeeping software, more enhances efficiency by removing the need for hand-operated data entry and reconciliations.

In addition, specialist payroll solutions offer protected data management and discretion. They use robust protection actions to protect sensitive staff member info, reducing the risk of information breaches and making certain compliance with information defense policies. On the whole, the advantages of expert payroll solutions add to cost financial savings, accuracy, and peace of mind for professional services organizations.

Conclusion

To conclude, expert payroll services play an essential role in making certain regulatory adherence and decreasing compliance dangers for organizations. With their competence in tax obligation regulations and continuous monitoring of labor regulations updates, they supply beneficial assistance in navigating the complexities of pay-roll compliance. By leaving payroll duties to specialist solutions, businesses can focus on their core pop over to this site procedures while preserving legal compliance in their payroll processes.

To reduce conformity risks effectively in professional services companies, complete audits of pay-roll procedures and documents are critical.Navigating payroll compliance for professional solutions companies can be significantly structured via the use of specialist pay-roll services, using a variety of advantages that enhance efficiency and precision in taking care of pay-roll procedures. Professional pay-roll solution carriers are well-versed in the ins and outs of pay-roll guidelines and can ensure compliance with ever-changing laws and tax obligation demands. In general, the benefits of specialist payroll services contribute to cost financial savings, precision, and tranquility of mind for specialist services companies.

By entrusting payroll duties to specialist services, organizations can focus on their core operations while keeping lawful compliance in their payroll procedures.